Property Transfer Tax Exemption For First Time Buyers . buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. This article will help you understand the latest bsd. $500,000 or less, you can claim an exemption amount equal to the full amount of property transfer tax. additional buyer’s stamp duty (absd) of 35% will now apply on any transfer of residential property into a living trust. The applicable absd rate is based on the profile of the buyer on the date of purchase. the profile of the buyer. you are required to pay bsd for documents executed for the transfer or sale and purchase of property located in singapore. the first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you.

from www.pdffiller.com

buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. the profile of the buyer. $500,000 or less, you can claim an exemption amount equal to the full amount of property transfer tax. additional buyer’s stamp duty (absd) of 35% will now apply on any transfer of residential property into a living trust. The applicable absd rate is based on the profile of the buyer on the date of purchase. This article will help you understand the latest bsd. the first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you. you are required to pay bsd for documents executed for the transfer or sale and purchase of property located in singapore.

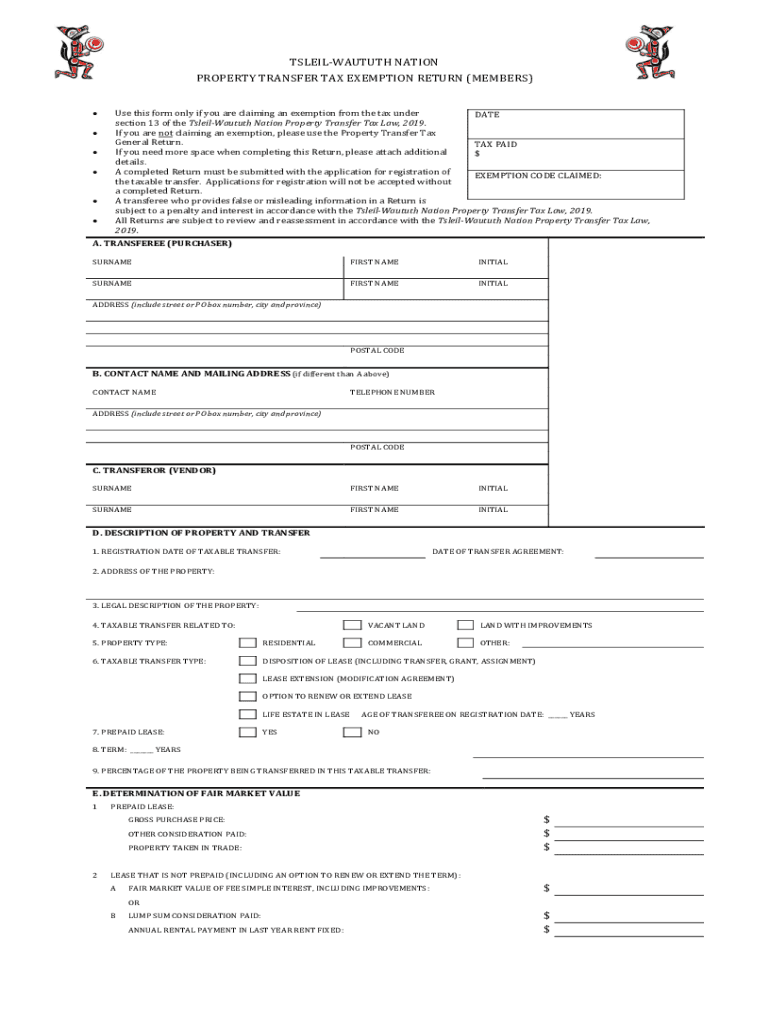

Fillable Online Property transfer tax exemptions Province of British

Property Transfer Tax Exemption For First Time Buyers the profile of the buyer. you are required to pay bsd for documents executed for the transfer or sale and purchase of property located in singapore. This article will help you understand the latest bsd. additional buyer’s stamp duty (absd) of 35% will now apply on any transfer of residential property into a living trust. the profile of the buyer. $500,000 or less, you can claim an exemption amount equal to the full amount of property transfer tax. buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. The applicable absd rate is based on the profile of the buyer on the date of purchase. the first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you.

From www.templateroller.com

Real Estate Transfer Tax Declaration and Exemption Form City of Property Transfer Tax Exemption For First Time Buyers buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. The applicable absd rate is based on the profile of the buyer on the date of purchase. you are required to pay bsd for documents executed for the transfer or sale and purchase of property located in singapore. the profile. Property Transfer Tax Exemption For First Time Buyers.

From www.youtube.com

How to get Exemption of the Transfer Tax for FirstTime Homebuyers in Property Transfer Tax Exemption For First Time Buyers you are required to pay bsd for documents executed for the transfer or sale and purchase of property located in singapore. This article will help you understand the latest bsd. buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. the profile of the buyer. additional buyer’s stamp duty. Property Transfer Tax Exemption For First Time Buyers.

From www.propertyguru.com.my

Stamp Duty Exemption for House Buyers Infographics Property Transfer Tax Exemption For First Time Buyers the profile of the buyer. buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. the first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you. additional buyer’s stamp duty (absd) of 35% will now apply on any transfer of residential. Property Transfer Tax Exemption For First Time Buyers.

From www.youtube.com

Delaware first time home buyer transfer tax exemption Property Transfer Tax Exemption For First Time Buyers The applicable absd rate is based on the profile of the buyer on the date of purchase. This article will help you understand the latest bsd. the profile of the buyer. additional buyer’s stamp duty (absd) of 35% will now apply on any transfer of residential property into a living trust. $500,000 or less, you can claim. Property Transfer Tax Exemption For First Time Buyers.

From anytimeestimate.com

Pennsylvania Deed Transfer Tax (2022 Rates by County) Property Transfer Tax Exemption For First Time Buyers you are required to pay bsd for documents executed for the transfer or sale and purchase of property located in singapore. buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. the first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you.. Property Transfer Tax Exemption For First Time Buyers.

From www.youtube.com

Property Transfer Tax First Time Home Buyer Exemption YouTube Property Transfer Tax Exemption For First Time Buyers This article will help you understand the latest bsd. you are required to pay bsd for documents executed for the transfer or sale and purchase of property located in singapore. additional buyer’s stamp duty (absd) of 35% will now apply on any transfer of residential property into a living trust. $500,000 or less, you can claim an. Property Transfer Tax Exemption For First Time Buyers.

From www.youtube.com

Property Transfer Tax Exemption Update for FirstTime Home Buyers and Property Transfer Tax Exemption For First Time Buyers the profile of the buyer. $500,000 or less, you can claim an exemption amount equal to the full amount of property transfer tax. the first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you. buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying. Property Transfer Tax Exemption For First Time Buyers.

From www.sampleforms.com

FREE 22+ Sample Tax Forms in PDF Excel MS Word Property Transfer Tax Exemption For First Time Buyers the first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you. additional buyer’s stamp duty (absd) of 35% will now apply on any transfer of residential property into a living trust. $500,000 or less, you can claim an exemption amount equal to the full amount of property transfer tax.. Property Transfer Tax Exemption For First Time Buyers.

From delawaremortgageloans.net

Delaware First Time Home Buyer State Transfer Tax Exemption Get FHA Property Transfer Tax Exemption For First Time Buyers the profile of the buyer. This article will help you understand the latest bsd. buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. $500,000 or less, you can claim an exemption amount equal to the full amount of property transfer tax. you are required to pay bsd for. Property Transfer Tax Exemption For First Time Buyers.

From delawaremortgageloans.net

Delaware Property Transfer Tax Exemption for First Time Home Buyers Property Transfer Tax Exemption For First Time Buyers you are required to pay bsd for documents executed for the transfer or sale and purchase of property located in singapore. This article will help you understand the latest bsd. the first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you. the profile of the buyer. buyer's stamp. Property Transfer Tax Exemption For First Time Buyers.

From www.exemptform.com

Riverside County Tax Exemption Form Property Transfer Tax Exemption For First Time Buyers the first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you. buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. additional buyer’s stamp duty (absd) of 35% will now apply on any transfer of residential property into a living trust. Web. Property Transfer Tax Exemption For First Time Buyers.

From www.youtube.com

Property Transfer Tax and Ways to be Exempt YouTube Property Transfer Tax Exemption For First Time Buyers the profile of the buyer. The applicable absd rate is based on the profile of the buyer on the date of purchase. additional buyer’s stamp duty (absd) of 35% will now apply on any transfer of residential property into a living trust. $500,000 or less, you can claim an exemption amount equal to the full amount of. Property Transfer Tax Exemption For First Time Buyers.

From www.linkedin.com

New Home Property Transfer Tax Exemption in BC Property Transfer Tax Exemption For First Time Buyers the first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you. the profile of the buyer. buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. This article will help you understand the latest bsd. The applicable absd rate is based on. Property Transfer Tax Exemption For First Time Buyers.

From asrlawfirm.com

Real Property Transfer Taxes in Florida ASR Law Firm Property Transfer Tax Exemption For First Time Buyers you are required to pay bsd for documents executed for the transfer or sale and purchase of property located in singapore. $500,000 or less, you can claim an exemption amount equal to the full amount of property transfer tax. buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. This. Property Transfer Tax Exemption For First Time Buyers.

From listwithclever.com

What Are Transfer Taxes? Property Transfer Tax Exemption For First Time Buyers buyer's stamp duty (bsd) is a tax of up to 6% incurred upon buying property in singapore. you are required to pay bsd for documents executed for the transfer or sale and purchase of property located in singapore. This article will help you understand the latest bsd. additional buyer’s stamp duty (absd) of 35% will now apply. Property Transfer Tax Exemption For First Time Buyers.

From www.youtube.com

NEW Increase Property Transfer TAX exemption for BC First Time and New Property Transfer Tax Exemption For First Time Buyers The applicable absd rate is based on the profile of the buyer on the date of purchase. the profile of the buyer. This article will help you understand the latest bsd. $500,000 or less, you can claim an exemption amount equal to the full amount of property transfer tax. buyer's stamp duty (bsd) is a tax of. Property Transfer Tax Exemption For First Time Buyers.

From www.pdffiller.com

Fillable Online Property transfer tax exemptions Province of British Property Transfer Tax Exemption For First Time Buyers This article will help you understand the latest bsd. $500,000 or less, you can claim an exemption amount equal to the full amount of property transfer tax. you are required to pay bsd for documents executed for the transfer or sale and purchase of property located in singapore. buyer's stamp duty (bsd) is a tax of up. Property Transfer Tax Exemption For First Time Buyers.

From dailyhive.com

Foreign buyers only account for 5 Metro Vancouver real estate sales Property Transfer Tax Exemption For First Time Buyers $500,000 or less, you can claim an exemption amount equal to the full amount of property transfer tax. the first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you. The applicable absd rate is based on the profile of the buyer on the date of purchase. the profile of. Property Transfer Tax Exemption For First Time Buyers.